Your complete source for financing short and long-term investment property

Your complete source for financing short and long-term investment property

Buy & Hold | BRRRR Method | Fix & Flip | New Construction

No matter what your strategy we have financing options to help you succeed.

Grow your portfolio faster with alternative, cash-flow based DSCR lending.

DSCR = Debt Service Coverage Ratio.

DSCR is the ratio of rental income to total mortgage payment (PITI). DSCR loans allow qualifying based on the rental income of the property, not your personal income. These cash-flow based loan programs measure a property’s ability to cover the debt service with rental income and make it easier for investors to build a portfolio.

DSCR ratios are allowed down to 0.75% but are most commonly required to be 1.0% or greater. A DSCR of 1.0% means that the rental income is equal to the total debt service payment. Use our simple DSCR calculator to estimate the ratio on your project. —>

| P&I | |

|---|---|

| Taxes | |

| Insurance | |

| HOA | |

| Total PITI | |

| Total Rent | |

| DSCR |

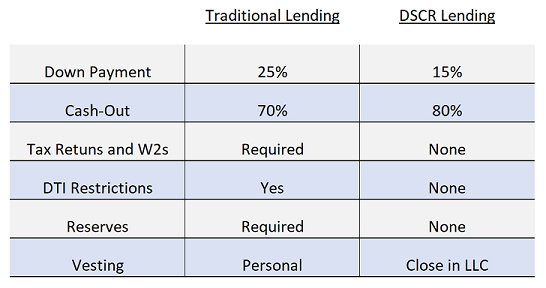

The key to maximizing the BRRRR strategy is lower down payments and higher cash-out amounts. Investors can acquire more property with lower down payments combined with the ability to pull out more equity with DSCR compared to traditional lending.

Pre-Qualification uses a Soft Credit Inquiry so your credit score is not affected. There is no cost and no obligation when getting pre-qualified.

No Personal Income

No Tax Returns or W2’s

No Debt-To-Income Ratio

Lower Down Payment

No Reserves Needed

Unlimited Properties Owned

Higher Cash-Out

Less Paperwork

Close in an LLC

Interest-only payments are available with no LTV or FICO restrictions

Increase loan term to 40-years to lower the payment and increase cash-flow

Pre-Qualification uses a Soft Credit Inquiry so your credit score is not affected. There is no cost and no obligation when getting pre-qualified.